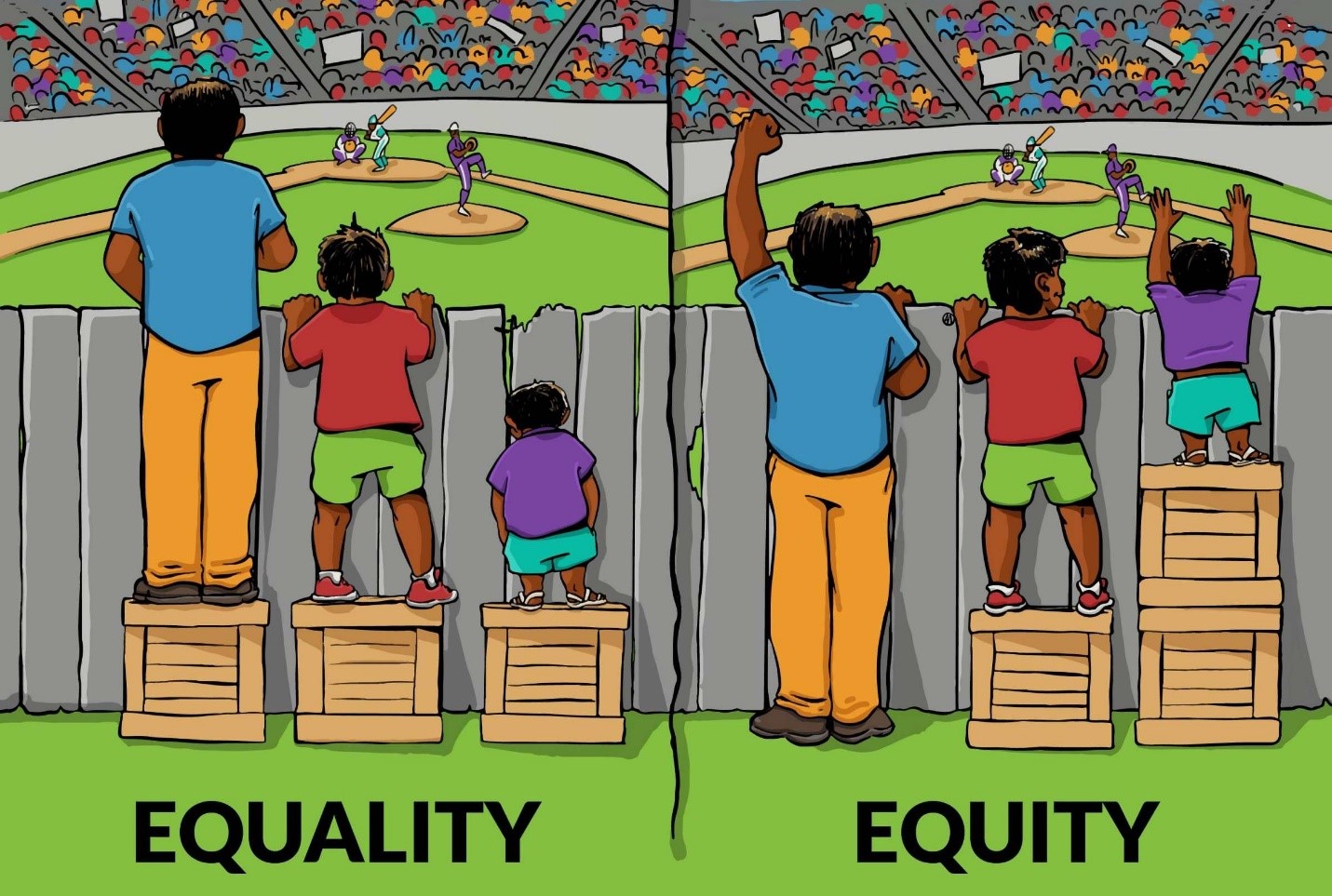

Economic empowerment is synonymous with uplifting the culture and taxes are a huge part of the equation. As a part of our commitment to (economic) equity, we connected with our Client, Anthony Paul, who advises some of the highest earners in the NFL as the Managing Director of the Hamilton Group to outline some of the key things you need to know about filing your 2020 taxes by May 17th, 2021:

- Tax Credits and Deductions — the American Rescue Plan Act (ARP) includes numerous tax credits for the average person.

- Recovery Rebate Credit (aka Stimulus Relief) provides eligible taxpayers who didn’t get the stimulus money that was owed to them (see line 30 of your 2020 tax return).

- Child Tax Credit — you may be eligible for a tax credit of up to $2,000 per dependent child age 16 and younger, if your household income is below $200,000 for single filers or $400,000 for joint filers.

- Unemployment Benefits — the ARP act includes a provision that waives taxes on the first $10,200 of unemployment benefits for individual taxpayers, and double that ($20,400) if you’re filing jointly and your spouse also received unemployment benefits in 2020.

- Medical Expenses — Only medical expenses that exceed 7.5% of adjusted gross income (AGI) can be deducted in 2020.

- Charitable Donations — Under the CARES Act, the cash donation limit has temporarily increased to 100% of your adjusted gross income. Below is a list of our extraordinary non-profit partners:

In response to people who say finances are not their “thing,” Anthony Paul says, “as 2020 showed us, finances should be everybody’s thing. Instead of looking at the cat dancing on Tik Tok, we should invest our time in things that teach us about managing and keeping our money.”

Recent Comments